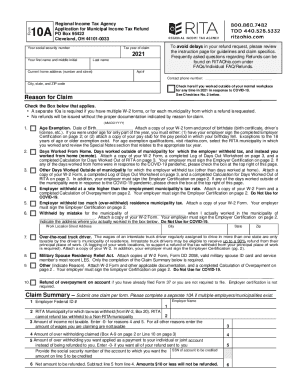

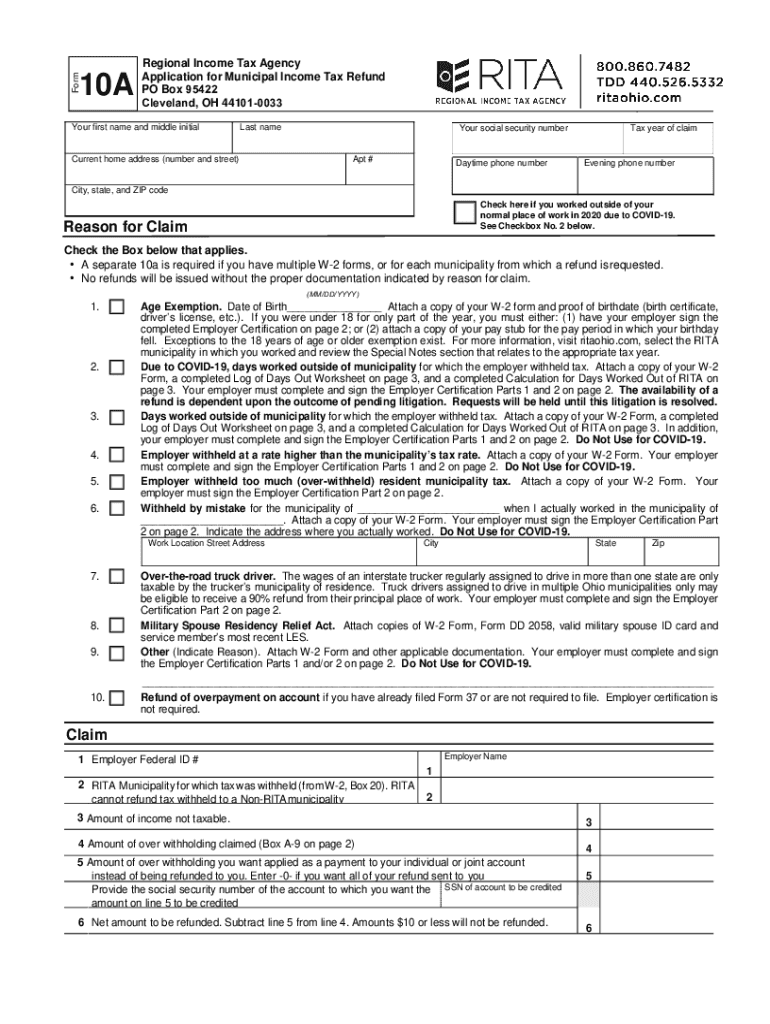

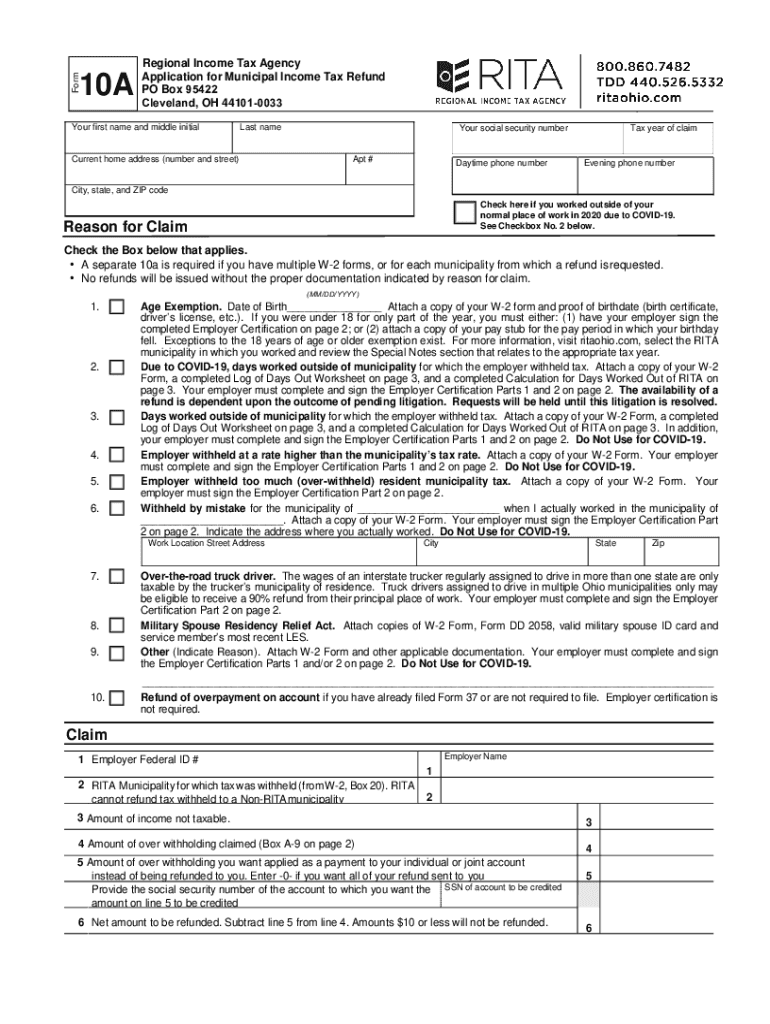

OH RITA 10A 2020 free printable template

Show details

Important Changes to the Tax Year 2020 Form 10A Application

for Municipal Income Tax Refund Related to COVID-19

You must check the box at the top of Form 10A if any portion of

your application for

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your rita 10a form 2020 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rita 10a form 2020 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rita 10a form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ohio 10 a form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

OH RITA 10A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rita 10a form 2020

How to fill out rita 10a form:

01

Start by downloading the rita 10a form from the official website or obtain a physical copy from the relevant authority.

02

Read and understand the instructions provided on the form to ensure accurate completion.

03

Begin by entering your personal information, such as your full name, address, date of birth, and contact details in the designated fields.

04

Provide any additional information required, such as your social security number or taxpayer identification number, depending on the purpose of the form.

05

If applicable, indicate your filing status, such as single, married filing jointly, or head of household.

06

Fill in the details of your income, including wages, salaries, tips, and any other sources of income as required.

07

Deduct any applicable deductions and exemptions to calculate your taxable income.

08

If you have any investment income, report it accordingly in the respective section of the form.

09

Review the completed form for accuracy and make any necessary corrections before submitting it.

10

Sign and date the form to certify the information provided is true and accurate.

Who needs rita 10a form:

01

Individuals who are residents or taxpayers of a specific jurisdiction as determined by the relevant authority may need to fill out the rita 10a form.

02

This form is necessary for reporting personal income, taxes owed, and determining tax liabilities.

03

It is typically required to be filed annually by individuals who meet certain income thresholds or have specific income sources.

04

The rita 10a form is also necessary for claiming tax credits, deductions, or exemptions that may be applicable to an individual's tax situation.

05

The specific criteria for who needs to fill out the rita 10a form may vary depending on the jurisdiction and tax laws of that particular region.

Fill how to form 10a : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

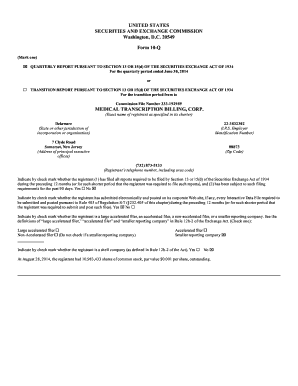

What is rita 10a form?

The RITA 10A form is a document used to report revenue and income taxes to the Ohio Department of Taxation. It is used by businesses located in the City of Cleveland and other municipalities within Cuyahoga County. It is also used to report withholding tax payments from employees and other related taxes.

What is the purpose of rita 10a form?

The RITA 10A form is an Ohio tax return form used to report income from business activities, such as self-employment, rental activities, and capital gains. It is used to calculate taxes owed on the income from these activities, and it must be filed in addition to the regular Ohio state tax return.

When is the deadline to file rita 10a form in 2023?

The deadline to file Form 1040 in 2023 is April 15, 2024.

What is the penalty for the late filing of rita 10a form?

The penalty for late filing of a Rita 10A form is a fine of up to $10,000 and/or imprisonment for up to two years.

Who is required to file rita 10a form?

The Real Estate Investment Trust (REIT) is required to file Form RITA 10A.

How to fill out rita 10a form?

The RITA 10A form is used for reporting municipal income tax withholding information. To fill out the form, follow these steps:

1. Download the RITA 10A form from the Regional Income Tax Agency (RITA) website or obtain a physical copy from your employer or the municipal tax office.

2. Enter the taxpayer's name, social security number, and contact information in the appropriate fields at the top of the form.

3. Complete the "Employer Information" section by providing the employer's name, address, and telephone number.

4. Fill in the "Period Ending" field to indicate the last day of the reporting period.

5. Enter the total wages earned by the taxpayer during the reporting period on Line 1. This information can typically be found on the taxpayer's W-2 form.

6. Determine the taxable wages by subtracting any nontaxable compensation (such as health insurance premiums or contributions to retirement accounts) from the total wages. Enter this amount on Line 2.

7. Calculate the amount of income tax withheld by referencing the taxpayer's pay stubs or W-2 form. Enter this figure on Line 3.

8. On Line 4, calculate the total amount of Ohio income tax withheld from the taxpayer's wages.

9. Determine the amount of the municipal tax withheld, if applicable, and enter it on Line 5.

10. Calculate the total tax withheld by adding the amounts from Lines 4 and 5 together and enter the sum on Line 6.

11. If the taxpayer is entitled to a refund, enter the refund amount on Line 7. If they owe additional taxes, enter the amount owed on Line 8.

12. Complete the remaining sections of the form, including the taxpayer's signature and date.

13. Make a copy of the filled-out RITA 10A form for your records and submit the original to the appropriate tax authorities, typically the RITA or the local municipal tax office.

14. Keep track of the taxpayer's tax-related documents and store them safely for future reference and potential audits.

It's important to note that these instructions provide general guidance, and it's recommended to consult the official RITA instructions or a tax professional for specific guidance related to your individual circumstances.

What information must be reported on rita 10a form?

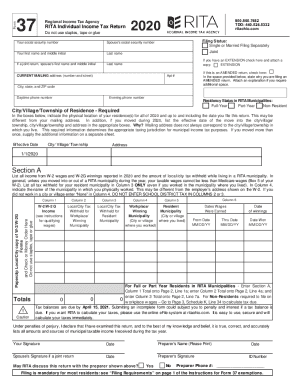

The RITA 10A form, or the Individual Income Tax Return Form for residents of RITA (Regional Income Tax Agency) municipalities in Ohio, requires taxpayers to report various information. Here is a general overview of the information typically required on the RITA 10A form:

1. Personal Information: This includes details such as name, address, Social Security number, and the municipality in which you reside.

2. Filing Status: Indicate your filing status (e.g., single, married filing jointly, head of household).

3. Income: Report all sources of income, including wages, salaries, tips, self-employment income, rental income, interest, dividends, pensions, etc. Attach necessary supporting documents like W-2 forms, 1099 forms, and schedules if applicable.

4. Deductions: Report eligible deductions, such as the standard deduction or itemized deductions (if applicable), and attach appropriate schedules if necessary.

5. Tax Credits: Report any eligible tax credits, which may include credits for dependents, education expenses, energy-efficient improvements, etc.

6. Local Tax Information: Provide details regarding any local tax withheld or paid during the tax year.

7. Estimated Payments: Indicate any estimated tax payments made throughout the year.

8. Other Information: Report any additional relevant information required by RITA, such as previous-year tax credits, unemployment compensation, partnership income, etc.

9. Signature: Sign and date the form to declare that the information provided is accurate to the best of your knowledge.

It's worth noting that the specific details required on the RITA 10A form may vary slightly from year to year, and some additional schedules or attachments may be needed for certain types of income or deductions. Therefore, it is always advisable to review the most current version of the RITA 10A form and any accompanying instructions provided by RITA.

How do I modify my rita 10a form in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your ohio 10 a form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit rita form 10a tax from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like form rita 10a pdf, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send form 10a pdf to be eSigned by others?

When your rita form 10a fillable is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Fill out your rita 10a form 2020 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rita Form 10a Tax is not the form you're looking for?Search for another form here.

Keywords relevant to rita form 10a instructions

Related to rita form 10a

If you believe that this page should be taken down, please follow our DMCA take down process

here

.